Will State Farm Pay for Tree Removal in Michigan?

If a tree just came down on your property, you’re probably stressed, overwhelmed, and asking the same question we hear all the time: Will State Farm pay for tree removal?

Sometimes the answer is yes. Other times, it’s no. And the difference matters, because tree removal can be urgent, dangerous, and expensive if handled the wrong way.

At Trumpp Tree Service, we’ve helped homeowners and HOAs across Southeastern Michigan deal with storm damage, fallen trees, and emergency situations for decades. Let’s walk through exactly when State Farm may help cover tree removal, when they usually won’t, and what to do next to protect your home and your peace of mind.

Key Takeaways: Will State Farm Pay for Tree Removal?

State Farm may pay if a tree falls due to a covered event and damages a covered structure

Coverage is usually limited, often $500–$1,000

Deductibles apply

Preventive tree removal is not covered

Trees that fall without causing damage are usually not covered

Professional removal is always the safest option

How State Farm Looks at Tree Removal Claims

Here’s the most important thing to understand up front: State Farm doesn’t cover tree removal just because a tree needs to come down.

In general, coverage depends on three things:

Whether the tree fell suddenly

Whether it fell because of a covered event, like a storm or high winds

Whether it caused damage to a covered structure or blocked access

If no damage occurred, insurance typically treats tree removal as routine property maintenance.

When Would State Farm Potentially Pay for Tree Removal?

There are a few clear situations where State Farm may help with tree removal costs. These are the cases we see most often after Michigan storms.

If A Tree Falls and Damages Your Home or Structures

This is the most common scenario where coverage applies.

If a tree falls because of a covered event, such as wind, lightning, or a storm, and damages a covered structure, State Farm may help pay for:

Removing the portion of the tree that caused the damage

Repairs to your home, garage, fence, shed, or other insured structures

In these cases, tree removal is usually included under debris removal, not treated as a separate service.

A Tree Blocks Access After a Storm

Even without structural damage, State Farm may cover removal if a fallen tree:

Blocks your driveway

Prevents access to your home

Blocks an accessibility ramp or required entry point

The key factor is that the tree must have fallen due to a covered event, not a gradual decline.

The Tree Came From a Neighbor’s Property

Who owned the tree doesn’t usually matter. State Farm focuses on where the tree landed, not where it came from.

If your neighbor’s healthy tree falls onto your home during a storm, your policy is typically the one involved. However, if the tree was already dead or dying, it could be your neighbor's responsibility to take care of it. Talk with your insurance company or a lawyer to completely understand who’s responsible.

When State Farm Usually Will Not Pay For Tree Removal

This is where many homeowners are caught off guard. A lot of tree removal situations aren’t covered, even when the tree looks dangerous.

The Tree Fell Without Causing Damage

If a tree falls in your yard and:

Doesn’t hit your house

Doesn’t damage a fence or structure

Doesn’t block access

Insurance usually won’t cover removal. In these cases, the answer to Will State Farm pay for tree removal is typically no.

Preventive or “Just in Case” Tree Removal

Insurance does not cover:

Dead trees

Diseased trees

Leaning trees

Trees removed before they fall

Even if a tree feels unsafe, insurance usually requires actual damage, not potential risk.

Long-Term Neglect or Maintenance Issues

If a tree falls due to obvious long-term neglect, coverage may be limited or denied. Homeowners' insurance expects basic property maintenance to be handled by the homeowner.

Coverage Limits You Should Know About

Even when State Farm does help, coverage isn’t unlimited.

Debris Removal Caps

Most policies cap debris or tree removal coverage, often around:

$500–$1,000 per incident

Sometimes a per-tree maximum

Large trees can exceed these limits quickly.

Your Deductible Still Applies

Your homeowners' insurance deductible applies to tree-related claims. If removal and repairs are close to your deductible amount, filing a claim may not be worth it.

We always recommend reviewing this with your agent before moving forward.

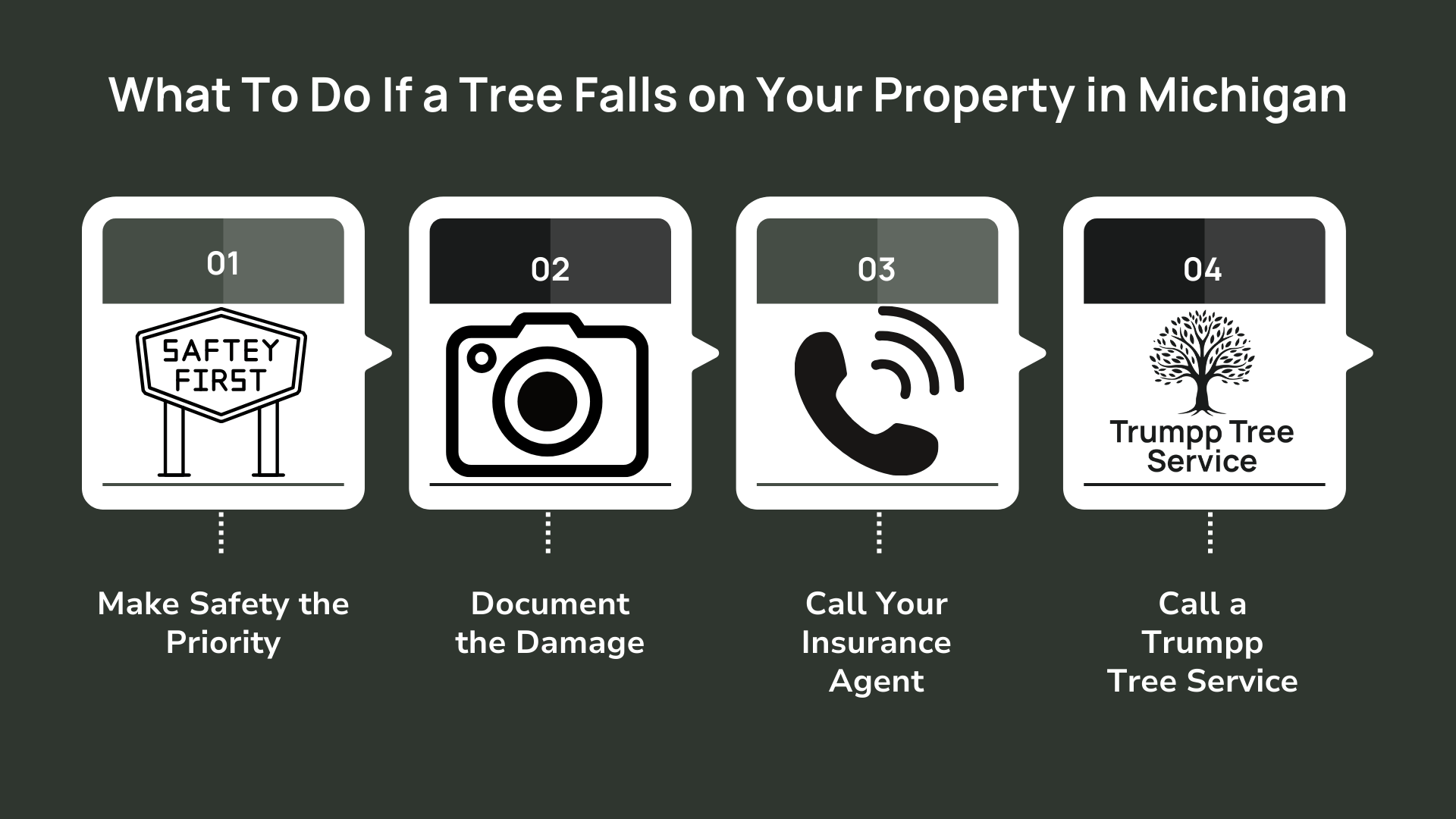

What To Do If a Tree Falls on Your Property in Michigan

When a tree comes down, timing and safety matter.

Step 1: Make Safety the Priority

Stay clear of the area. Watch for hanging limbs, unstable trunks, and downed power lines. If the situation feels unsafe, call a professional immediately.

Step 2: Document the Damage

Take clear photos of:

Where the tree landed

Any damage to structures

The size and position of the tree

This helps if you decide to contact State Farm.

Step 3: Call Your Insurance Agent

Explain what happened and ask:

Whether removal may be covered

What documentation they need

Whether emergency mitigation is recommended

Step 4: Call a Professional Tree Service (Like Trumpp Tree Service)

Storm-damaged trees are unpredictable. Even experienced homeowners shouldn’t attempt removal themselves.

At Trumpp Tree Service, we respond quickly, explain your options clearly, and handle dangerous removals safely, often within hours.

Why Homeowners Call Us Even When Insurance Won’t Pay

Insurance or not, a dangerous tree still needs to be handled properly.

We regularly help with:

Emergency storm damage

Trees near homes or power lines

HOA and gated community work

Same-day or next-day service

Complete cleanup with no mess left behind

Our pricing is clear, fair, and transparent. No surprises. No pressure.

When It’s Time to Call a Professional, Insurance or Not

If a tree is leaning toward your home, damaged by a storm, tangled near power lines, dropping large limbs, or simply doesn’t feel right, don’t wait.

We’ve helped homeowners and HOAs across Clarkston, Rochester, Waterford, Brighton, Bloomfield, Milford, Auburn Hills, and surrounding areas handle tree problems safely and quickly.

Local, Reliable Help You Can Trust

At Trumpp Tree Service, we’re licensed, insured, and covered by workers’ comp. We specialize in hazardous and emergency tree removals, and we treat every property like it’s our own.

If you’re asking Will State Farm pay for tree removal, let us help you take the next safe step.

We can be there within hours.

Fast. Local. Safe. Done right the first time!

Frequently Asked Questions

Will State Farm pay for tree removal if it hits my house?

Often, yes, if the tree fell due to a covered event and damaged a covered structure.

What if the tree falls in my yard?

If it doesn’t damage anything or block access, insurance usually won’t cover removal.

Does insurance pay to remove dead or leaning trees?

No. Preventive removal is typically the homeowner’s responsibility.

How quickly can Trumpp Tree Service respond?

We often respond the same day or within 24–72 hours, including emergencies.

Are you licensed and insured?

Yes. Fully licensed, insured, and covered by workers’ compensation.

Do you handle cleanup?

Absolutely. We remove all debris and leave your property clean and safe.

Will State Farm pay for tree removal if the tree hasn’t fallen yet but is dangerous?

No. State Farm typically does not cover preventive or “at-risk” tree removal. Even if a tree is leaning, cracked, or appears unsafe, insurance usually requires actual damage caused by a sudden event before coverage applies.

Does State Farm cover tree removal after a storm if only branches fell?

It depends. If fallen branches caused damage to a covered structure or blocked access to your home, removal may be covered under debris removal. If branches fell without causing damage, coverage is unlikely.

Is tree removal covered if the tree damages my fence or shed?

Often, yes. Fences, sheds, and detached garages are usually considered covered structures, though coverage limits may differ. Your deductible and debris removal caps still apply.

What if a tree damages my neighbor’s property? Who files the claim?

Typically, the insurance policy covering the damaged property responds first, regardless of where the tree came from. Liability may come into play if negligence is proven, but insurance companies usually handle this determination.

Does State Farm cover stump removal after a tree falls?

Usually no. Stump removal is generally considered cleanup or landscaping, not emergency debris removal, and is often excluded from coverage.

Can I choose my own tree service for insurance-related work?

Yes. Homeowners are not required to use an insurance-recommended contractor. You can choose a licensed, insured local company like Trumpp Tree Service that prioritizes safety and proper cleanup.

What if the cost of tree removal is less than my deductible?

If the total cost is below your deductible, insurance will not contribute. In these situations, it’s often faster and simpler to handle removal directly with a professional tree service.

Does filing a tree removal claim increase my insurance rates?

It can, depending on the size of the claim and your overall claims history. This is why it’s important to weigh the cost of removal against your deductible and potential premium impact.